What is good governance and why does it matter?

Stay up-to-date on trends shaping the future of governance.

The journey from complexity to clarity over the principles of good governance in private and public sectors

Over the years, I have had the opportunity to serve on governing bodies of quite a wide range of organizations: private companies, publicly owned development finance entities, public-private partnerships, associations, non-profits, even a church. I have seen at first hand the difference which governance makes in whether an organization achieves its purpose or not. As a result, I have a high view of the difference governance can make--but also a realistic understanding of how often the topic is clouded in mystery, even mystique. And how often the difference governance makes to organizations is not positive!

The growing jungle of governance complexity

Because of its sprawling nature, the topic of governance remains slightly murky notwithstanding three decades of attempts to define it and codify it in specific sectors.

In the private sector, the pioneering work of the Cadbury Committee spotlighted the shortcomings of governance within the UK corporate environment in its landmark 1992 report. Since then, codes of good corporate governance for listed companies have proliferated around the world. Activist investors have taken up the charge to go beyond code compliance. Today, mainstream investment managers espouse reporting against ‘ESG’ frameworks, where the G stands for governance right alongside a company’s environmental and social impact. Funds which screen for ESG performance have attracted ever-increasing inflows as investors vote with their wallets in favor of companies performing according to these indicators.

The public sector has not been left out of the growing focus on governance. Back in 2009, a UN agency defined good public governance in terms of eight characteristics: it is participatory, consensus oriented, accountable, transparent, responsive, effective and efficient, equitable and inclusive and follows the rule of law. Political scientist Francis Fukuyama has gone further to argue that good governance is the biggest factor explaining differences in the wealth of nations. But he has also pointed out what he calls the ‘getting to Denmark’ problem: that there is no one easy technocratic path which leads to good governance.

Good governance: a unifying definition at last

Even as these parallel tracks of sector-based discussions have unfolded and spawned much analysis and many indices, we have lacked a unifying framework for understanding of what governance is about. However, there is some recent good news: in September 2021, following a three year process, international standard setting body ISO published a new standard (ISO 37000) for governance. It is built on a clear definition of governance as “the system by which an organization is directed, overseen and held accountable for achieving its defined purpose.”

I find this to be a useful definition for taking forward the discussion of how to promote good governance. First,

it covers organizations of all types, not only large companies, so it should help to reduce the fragmentation created by overlapping and varying codes and sets of principles. Second,

it recognizes that governance is a ‘system’—a group of interacting items which must form a whole—not just one single issue to extract from its context. This recognition brings complexity explicitly into the governance frame, allowing for great differentiation in the composition, structures and processes of governance bodies while accepting that these factors all interact. And third, the definition

links governance explicitly to achieving the organization’s purpose. Of course, ‘we’re all purpose-driven now’, to adapt the quotation about Keynesians attributed to Milton Friedman. I, for one, consider this generally a good thing. I do have reservations about how broadly the concept of purpose is defined and applied in some contexts but that is the subject of a future article. But by linking governance to purpose in the definition, the ISO standard neatly closes a loop:

all governance should promote the achievement of organizational purpose. This is not just an outcome of good governance. Governance which does not seek to achieve an organizational purpose is not just bad governance: it isn’t really governance worthy of the name at all. Of course, a corollary of this definition is that the first emphasis of governance should be to define and clarify an organization’s purpose. Much cyber-ink has already been spilled in defining purpose and measuring it, and much more is yet likely to be spent (which is another way of saying this will be the topic of a future article on this site). But at least the standard of governance is now about how it provides greater clarity of purpose and is accountable for progress towards this destination.

How much does governance matter and to whom?

While there is therefore more convergence now than even a decade ago about what governance is, the question remains as to how much it matters, and to whom. It is all too easy to respond ‘a lot’ and ‘to everyone’, just as we might when asked the same question about parenthood, or any other great natural ‘goods’.

Studies are now showing some of the payoffs from good governance. For example, recent research by New York City-based think tank Diligent Institute found that the top quintile of S&P500 companies in corporate governance rankings performed 15% better on average than the bottom quintile over a two year period to end 2018, concluding “Strong corporate governance is critical for companies that seek to maintain high performance and avoid devastating crises (See Diligent Institute - 2019 The High Cost of Governance Deficits: A Case For Modern Governance)." Research like this typically uses market capitalization as the measure of corporate performance. This of course captures the most traditional sense of corporate purpose—namely, return to shareholders. Broader measures are not yet widely available or consistent. To believe that these firms are meeting their wider purpose beyond financial return only, we must for now infer that capital markets are rewarding public companies which at least pay some attention to current measures of governance; and that this reward could help promote a virtuous circle towards better practices.

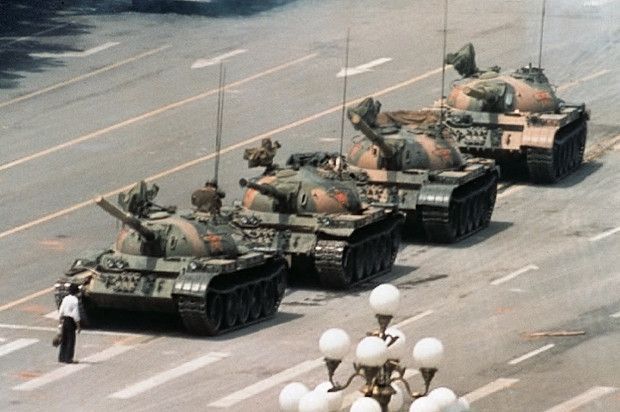

The reality today is that we notice governance more often by its absence. Our societies are made up of myriad organizations of greatly differing scales and types and with varying purposes. If significant organizations cannot and do not achieve their intended purposes, there is at very least a societal opportunity cost or deadweight loss. This failure may not be the fault of governance in the short run at least—execution also plays a vital role. Exogenous factors can also disrupt outcomes. But since governance determines whether and how organizations adapt and change over time in ways which can sustain or undermine their purpose, in the long run at least, organizational failure can be attributed to poor governance.

In respect of clarity of purpose, the new ISO37000 governance standard at least “eats its own dogfood”: the standard states its own purpose as promoting the achievement of certain Sustainable Development Goals (SDGs), specifically SDG 16: to “promote peaceful and inclusive societies for sustainable development, provide access to justice for all and build effective, accountable and inclusive institutions at all levels.” SDG16 serves as a foundation for achieving all the other SDGs, just as organizational governance underlies organizational performance. Organizations of all types are starting to express their purpose with reference in part to achieving SDGs. Whether ISO37000 can achieve this, it is at least a worthy aspiration to link governance to human development in this way.

Now that’s a purpose for organizational governance which I can certainly get behind!

At Integral, we provide ESG Consulting advice, evaluation, facilitation, mentoring and coaching services to develop governance systems that fit your organization’s purpose and stage of growth. To explore further how we can help you,

read about our services, or

set up a free consultation.

S H A R E