Cracking the Governance Code..or are the Codes Cracking?

Stay up-to-date on trends shaping the future of governance.

A case for moving beyond governance codes for early stage companies

The genesis corporate code

In 1992, a committee headed by Sir Adrian Cadbury fired the ‘shot heard around the world’ of corporate governance. Coming in the wake of a series of UK corporate fiascos, the Cadbury Committee ‘salvo’ included a set of good practices for large listed companies to follow. The Cadbury Code, as these practices came to be called, inspired a series of similar developments in other parts of the world. South Africa, for example, published its own King Code of Corporate Governance shortly afterwards in 1994.

The

EGCI database

now lists governance codes in dozens of countries, ranging from Brazil through Kenya to Vietnam. For public companies, cracking this type of code has increasingly meant adopting an approach of ‘apply

and

explain’, an evolution of the original ‘comply

or

explain’ which is technically only required by a few codes such as King. However, institutional investors increasingly require compliance in an age of escalating pressures on them to integrate ESG factors.

Time to ditch codes?

But could these governance codes themselves now be cracking under their own weight? A recent blog post by Cambridge law professors Bobby Reddy and Brian Cheffins makes that case in a stimulating short read. Under the title, “The 30 year itch: time to ditch the UK Corporate Governance Code”, Reddy and Cheffin make a compelling argument that, 30 years after the publication of the Cadbury Code in the UK, such codes have outlived their usefulness in the UK at least. They are now overarching in scope and effectiveness, as policy makers have broadened them to cover a wide range of issues not foreseen at the outset.

I find this argument compelling–especially as I observe the proliferation of well meaning ESG frameworks; and the process of weaving these frameworks into quite narrow, restrictive checklists. The outcome risks ‘straining out gnats and swallowing camels’. The risk is not only that ‘over governance’ will deter companies from listing on public exchanges, which is one of the main concerns of the Cambridge dons in respect of the London Stock Exchange. It is also that the proliferating codes send signals which can chill innovation even in segments of the corporate space to which they don’t (yet) apply–such as startups. Compliance with inappropriate rules or codes of any sort carries two types of costs: the direct costs of compliance which mount as codes become more sophisticated and require more time and resource to comply with; and the indirect costs including opportunity costs which come from over-conservative decision making or failure to take enough risk. The latter category may well become the largest over time, but unlike compliance costs, is harder to measure.

What does this mean for early stage entities?

The early stage investment space has been on my mind a lot this year. In a recent blog I wrote with co-authors Marc Herson and Sam Parker, we summarize the findings of a series of interviews conducted with funders and founders of early stage entities earlier this year. Clearly, fund managers are feeling the increasing pressure from investors to apply ESG analysis; and one logical way to satisfy them is to adopt a what I would call a ‘Code downwards’ approach. That is, taking the existing governance codes as the ‘Himalayas’ of corporate governance which all mature companies must ascend at some stage, but accepting that starting in the foothills is adequate, providing the path leads onwards and upwards. To be fair, the better codes explicitly encourage a proportionate approach to adoption which they claim allows even small and medium enterprises to apply stripped down versions.

At one level, ‘Code downwards’ approaches are intuitively appealing: after all, to climb Mount Everest, you must start in the foothills….mustn’t you? Certainly; but deciding which path to take depends very much on your desired angle of approach to the mountain. That choice may be affected by weather, skills, time available and so on. At one level, this states the obvious that there is seldom only one path up any mountain. But more importantly, there may not be only one mountain or range worthy of the climb.

So what are the alternatives to codes?

The Cambridge authors advocate abolishing the UK Corporate Governance Code, the offspring of Cadbury, but they are clear in their blog that they don’t advocate full scale deregulation. For the UK at least, they prefer limited and specific mandatory disclosure, rather than sprawling code-based disclosure. This alternative assumes that the regulatory making process can result in an appropriate set of disclosures.

Another alternative for early stage companies is to focus on the substance which good governance aspires to achieve and ask a different question i.e. not “how can I comply with these Codes when I grow up?” but rather “what does smart, agile and ethical decision making look like in the presence of multiple stakeholders?”

The answer will have to draw on a much wider range of inputs than accumulated legal or regulatory thinking alone. It is likely to include insights from behavioral science–such as those contained in Daniel Kahneman’s striking recent book with Cass Sunstein and Olivier Sibony called

Noise.

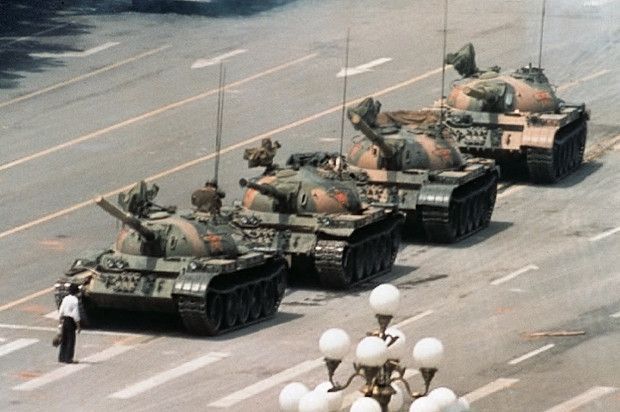

It is also likely to take into account how technology is redrawing the lines of where human judgment can be, and/or needs to be, deployed. It may well change today’s paradigm of meeting as a board of directors at punctuated intervals to collectively act out the set piece theater today called a ‘board meeting’ into a more fluid flow of information and decisions across time and space. It will probably also involve learning from all the current upheavals in crypto-governance, which is going through its own crises perhaps akin in scale to those which launched the Cadbury Code thirty years ago.

I have argued elsewhere that we can and should learn from these efforts which start from a different and more fundamental position than merely asking how to comply with corporate codes in future.

To be sure, there are many challenges to be addressed in finding the answer to what better organizational decision making looks like. But I would argue that this

bottom up approach

towards designing appropriate governance for early stage entities at least is more likely to result over time in discovering those mountains worth climbing other than the ‘Himalayas’ of today’s governance Codes. Embarking on this journey is one of the main purposes of the new

Agile Governance Platform

which my colleagues Sam Parker, Marc Herson and I have recently launched.

At Integral, we provide ESG Consulting advice, evaluation, facilitation, mentoring and coaching services to develop governance systems that fit your organization’s purpose and stage of growth. To explore further how we can help you,

read about our services, or

set up a free consultation.

S H A R E